I decided I need a budget.

I’ve been playing with some commercial software lately called YNAB (You Need A Budget). It’s good stuff.

A long time ago…when I graduated from college the first time though, I created a budget using a simple Excel spreadsheet. Based on my income, I allocated an amount for the payment I’d make each month on each of my debt & expense amounts – everything from my student loads to my rent, car payment, insurance, etc. I used the snowball method to apply any extra money from one debt to the next as I paid off each item in succession. It worked very well for me, such a simple tool, but my life was much simpler then, too.

Now I have multiple debit cards, bank accounts, I even have a credit card or two – one of the downsides of rebuilding credit is that I have a couple of credit cards and I use them each month as a means to improve my credit.

I downloaded a free trial of YNAB and gave it a try. They give you a month to try it out. I entered all of my information, very excited to find something that might actually help me start to have a plan for my income.

As usually happens with me, I soon fell off the YNAB wagon.

It became cumbersome to sit and enter my receipts, and even worse to try to enter information about online purchases. I used the excuse of “I’m working too many hours right now to do this…” and let it fall to the wayside.

Fast-forward to after the busy Christmas season at work, when I’m finally getting a day off of work here and there, and I found YNAB on my computer again. I also learned the developer just released an Android version, and hey, coincidence – I was just upgraded from a Blackberry at work to a Samsung smartphone.

As I’m prone to do when considering an expenditure of even $60, I researched a little more. The Android app is free because you need the full desktop version of the software to use it.

The mobile version, where you can enter receipts on the go and it automatically syncs with your desktop software, looks like this:

I also Googled “YNAB Promo Code” and came up with someone’s link that would save me $6 on the purchase. I spent the $54 on it and proceeded to activate the software, download the app to my work phone (we are allowed to use it for personal use, too) and started entering everything I could find from the gap of time when I first started the free trial through to today. This isn’t something that is going to happen in an hour, or even a week. While it’s fairly easy to download and get started (and they provide some awesome online “classes” to help you with that) it is time-intensive to enter your information.

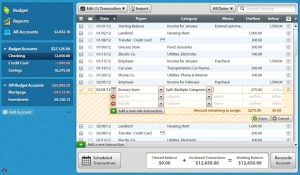

This is how the main account screen appears:

I’ll be posting weekly on how I’m doing with my fun new software and I’ll be brutally honest in whether I feel it’s helping me budget my income or not. After all, $54 is a lot to spend on something if you decide it’s too much effort to use.

In the meantime, if you’d like to give YNAB a try, click on any of the pictures in this link to take you to the YNAB webpage. And if you decide to buy it, I’d be grateful if you’d purchase through my referral link below – just click on the picture below – and this will save you $6 and net me $6 as well…which of course, I’ll put toward my debt annihilation project.

Stay tuned to see how YNAB works for me!